child tax credit september 2021

Portal says eligible but no payment issued. According to the Internal Revenue Service IRS to claim the 2021 Child Tax Credit you will need to enter the details of your children and other dependents on your Form.

Deadline Now Hours Away To Opt Out Of September Child Tax Credit Payment Fingerlakes1 Com

That depends on your household income and family size.

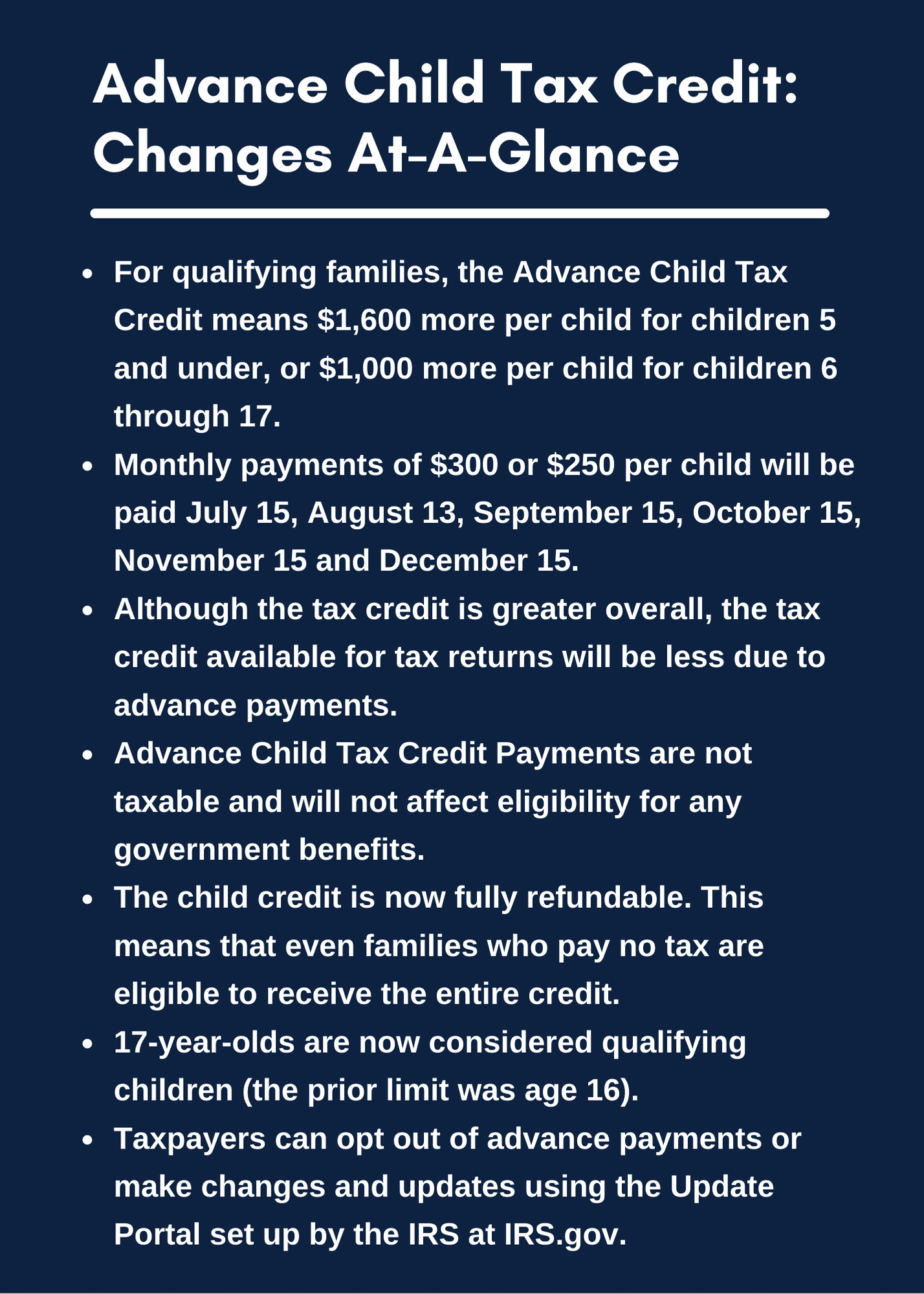

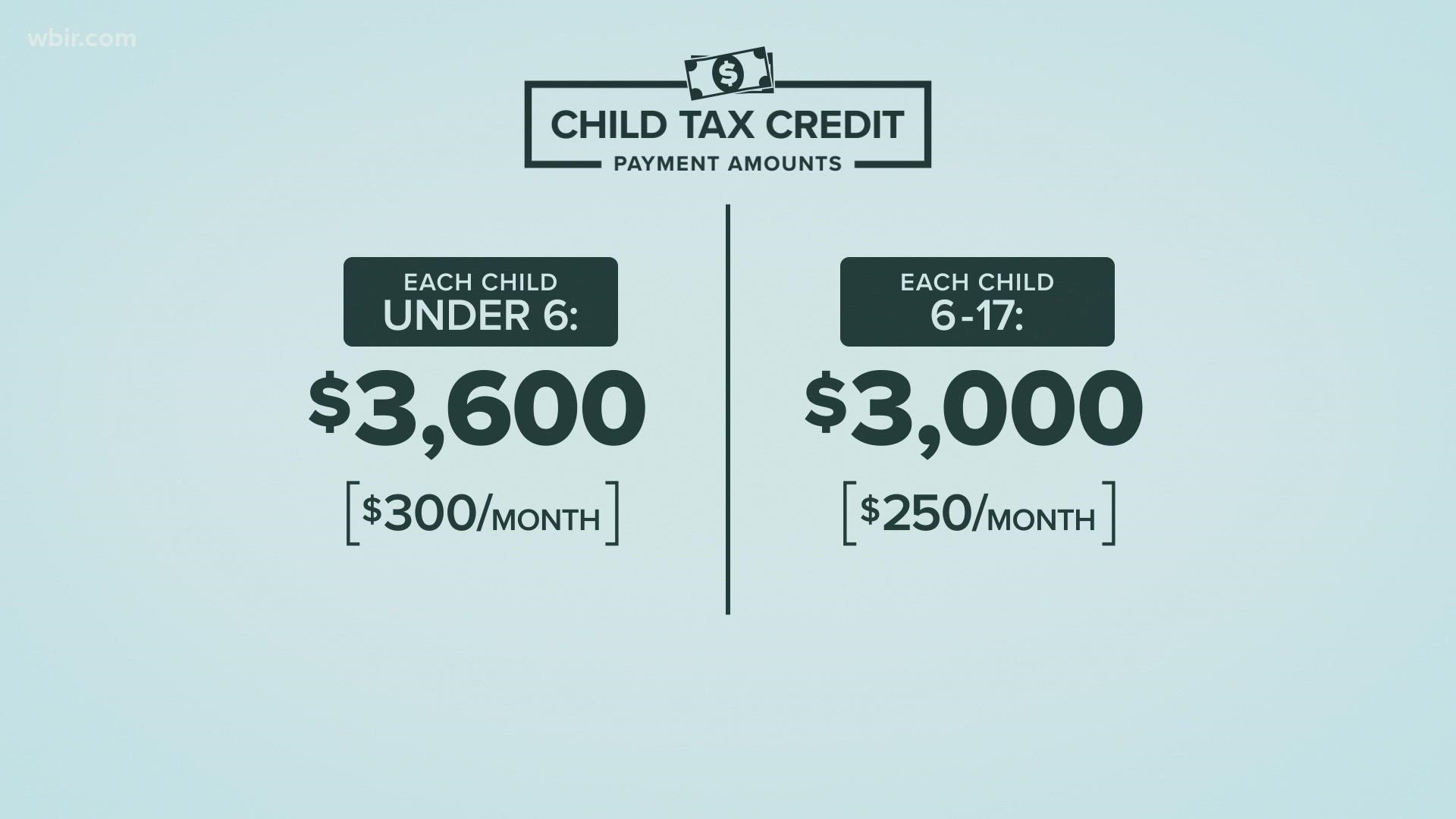

. How much will parents receive in September. Eligible families can receive a total of up to 3600 for each child under 6 and up to 3000 for each one age 6 to 17 for. Families with a single parent.

You qualify for the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual income is not more than. September 17 2021. How 2021 is Different.

July - They sent it DD to correct account August - Got caught in the glitch and mailed a check September- My DD info was removed payment. The American Rescue Plan increased the amount of the Child Tax Credit from 2000 to 3600 for qualifying children under age 6 and 3000 for. Children born in 2021 make you eligible for the 2021 tax credit of 3600 per child.

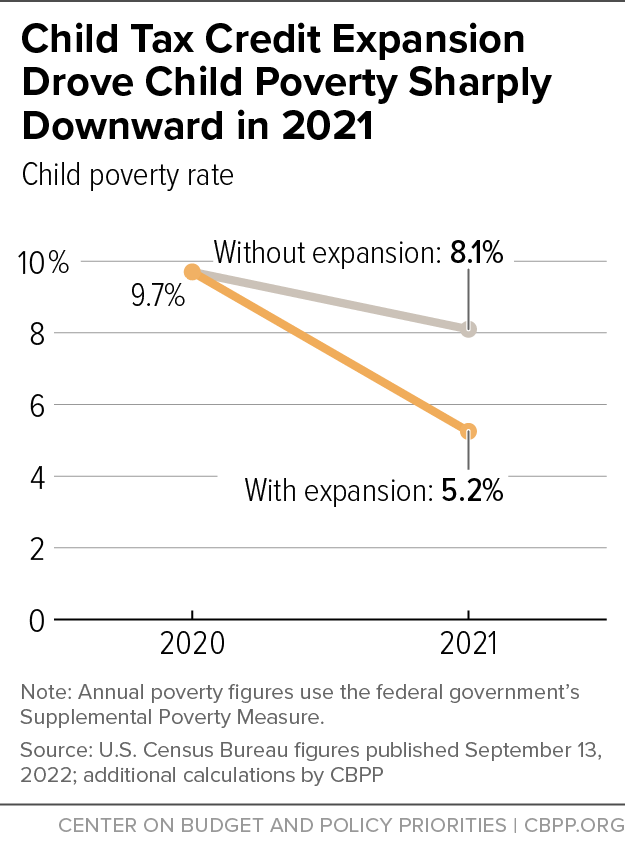

These people are eligible for the full 2021 Child Tax Credit for each qualifying child. This paper examines the impact of the expanded Child Tax Credit on child poverty. The IRS said it distributed the third advance child tax credit payments this week with no major hiccups.

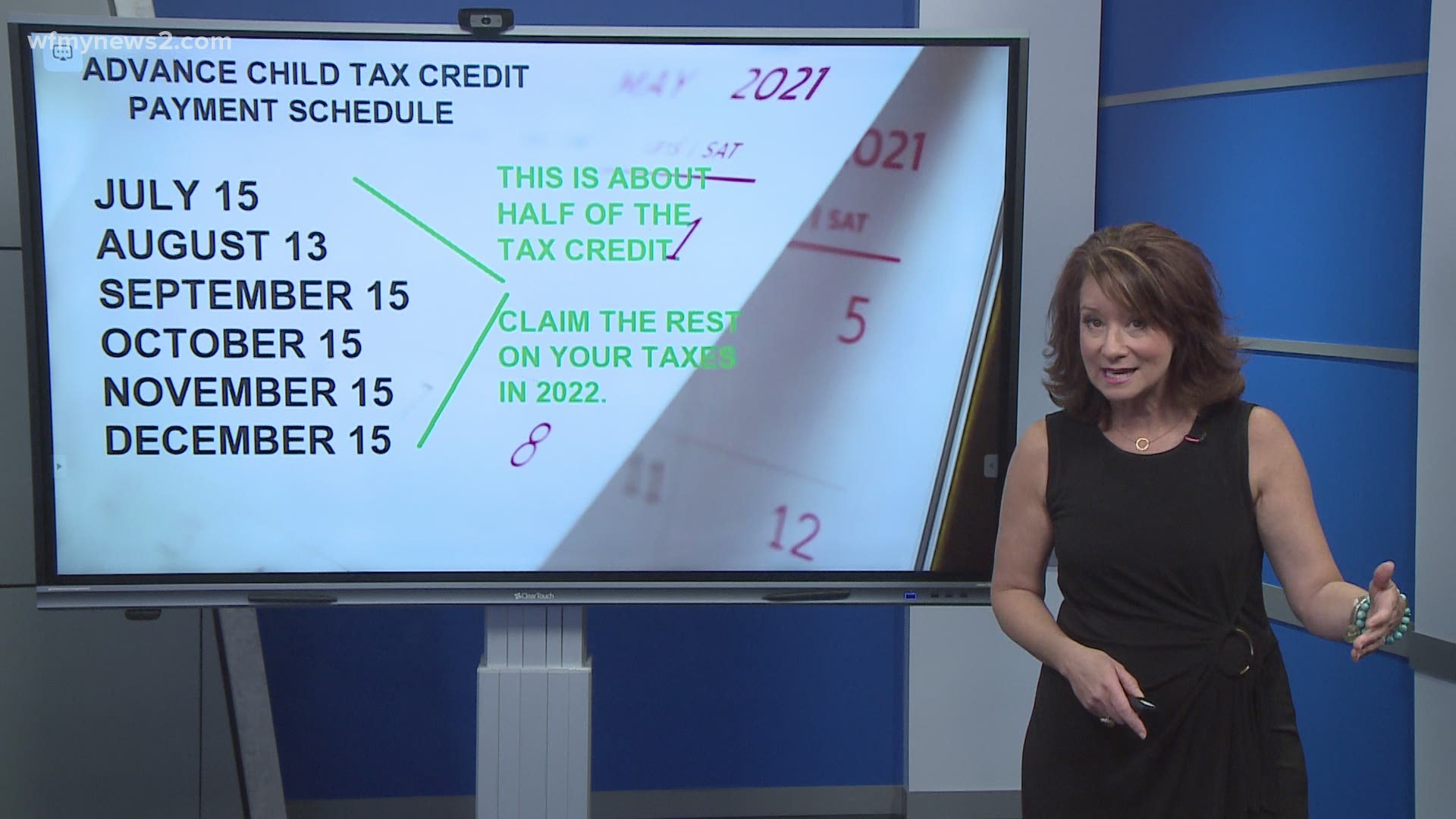

Under the American Rescue Plan of 2021 advance payments of up to half the 2021 Child Tax Credit were sent to eligible taxpayers. The Child Tax Credit. Families who did not get a July or August payment and are getting their first monthly payment in September will still receive their total advance payment for the year of up to 1800.

Or 200000 for all. We find that the Child Tax Credit lifted 29 million children out of poverty. Thanks to the American Rescue Plan the Child Tax Credit was increased and expanded for 2021.

Each child under six at the end of the year could be eligible for up to 3600 and those six through 17 at the end of 2021 could be eligible for up to 3000. Visit ChildTaxCreditgov for details. The 2021 Child Tax Credit was increased up to 3600 for children under age six and 3000 for those six to 17.

T21-0227 Tax Benefit of the Child Tax Credit CTC Extend ARP Provisions but Retain Current-Law Partial Refundability by Expanded Cash Income Percentiles 2022. So parents of a child under six receive. The third payment date is Wednesday September 15 with the IRS sending most of the checks via direct deposit.

Thanks to the American Rescue Plan the vast majority of families will receive 3000 per child ages 6-17 years old and 3600 per child under 6 as a result of the increased 2021 Child Tax. Up to 3600 per child under age 6 and up to 3000 per child ages 6 through 17. Half of the total is being paid as six monthly payments and half as a 2021 tax credit.

This week the IRS successfully delivered a third monthly round of approximately 35 million Child Tax Credits with a total value of about 15. The 2021 child tax credit gave families larger sums. 150000 if you are married and.

Married couples filing a joint return with income of 150000 or less. The Child Tax Credit wont begin to be reduced below 2000 per child until your modified AGI in 2021 exceeds. But more than 200 parents contacted CNBC Make It on Friday to say they.

The first half of the credit is being delivered in monthly direct deposits from July through December of 300 for children under 6 and 250 for those aged 6 to 17. Up to half of those sums was available. The American Rescue Plan Act changed the tax credit for just one year.

400000 if married and filing a joint return. The credit amount was increased for 2021. When does the Child Tax Credit arrive in September.

Most families are eligible to receive the credit for their children. Taxpayers can now claim a credit of 3000 for every dependent child between the. That drops to 3000 for each child ages six through 17.

To find out if your.

The 2021 Child Tax Credit Implications For Health Health Affairs

A 3 600 Fourth Stimulus Is Coming For Millions Of Americans Jobcase

Child Tax Credit 2021 How To Track September Next Payment Marca

Late Child Tax Credit Payments From Irs Arriving Now Fingerlakes1 Com

2021 Child Tax Credit Do You Qualify For The Full 3 600 Wcnc Com

Policymakers Should Expand Child Tax Credit In Year End Legislation To Fight Child Poverty Center On Budget And Policy Priorities

Sign Up For The Child Tax Credit Before November 15 2021 Chinese American Planning Council

Child Tax Credit Ff 02 22 2021 Tax Policy Center

Last Day To Unenroll In July Advanced Child Tax Credit Payment

The Final Child Tax Credit Payment Of 2021 Is Here Is It The Last One Ever Here S What Happens Next Marketwatch

What Is The Child Tax Credit And How Much Of It Is Refundable

Child Tax Credit Irs Retools Website To Update Address Other Changes Before September Payment The Verde Independent Cottonwood Az

Brproud Irs Issues Warning As Next Batch Of Child Tax Credit Payments Are Set To Go Out Next Month

Irs Makes First Payments Of Advanced Child Tax Credit On July 15 Wfmynews2 Com

Advance Child Tax Credit Payments Begin July 15

Final Child Tax Credit Payment Opt Out Deadline Is November 29 Kiplinger

Advance Child Tax Credit Payments Coming To A Bank Account Or Mailbox Near You Accountant In Orem Salt Lake City Ut Squire Company Pc

Child Tax Credit Faqs For Your 2021 Tax Return Kiplinger

Child Tax Credit 2021 When Will The September Payment Come Wbir Com